For many years now, the company car has been an endangered species – taxed virtually to the brink of extinction by successive Chancellors. However, a recent announcement by the Treasury could mean that this rare beast is about to enjoy something of a renaissance.

With diesel and petrol-powered vehicles contributing significantly to environmental problems, the government is taking action to encourage everyone – including company car drivers to make the switch to electric-powered vehicles. As part of this effort, changes to the way company cars are taxed as benefits in kind from next year will make electric company cars an attractive proposition for business owners and employees alike.

If you’re considering (or already have) a company car, want to take advantage of money-saving tax benefits – and improve your environmental credentials at the same time, now is definitely the time to consider going electric.

Just before we look at the changes coming in, let’s briefly refresh our minds about some of the key rules around acquiring a car through your limited company.

- If your company provides you with a car for private as well as business use, HMRC considers this to be a benefit in kind, and the value of the benefit is added onto your annual income and liable for tax. The charge due is calculated by applying a percentage figure to the original list price of the car based on the type of fuel it uses and its CO2 emissions.

- The only way you can avoid paying benefit in kind tax is if you use the vehicle exclusively for business and keep it at the business premises overnight.

- If you clock up zero personal miles, your company can recover 100% of the VAT you pay on the purchase of your vehicle – or 50% on your repayments if you lease it.

Company vehicles are a complex area. You’ll find more information about how they affect tax on you personally, and on your business in our blog ‘Should I Buy My Car Through My Limited Company?’

What’s Changing?

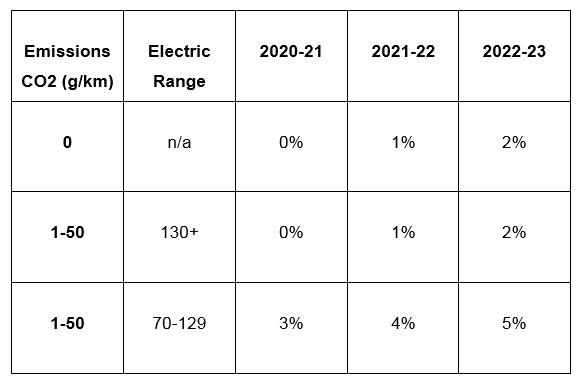

The government has confirmed that for the tax year 2020-21, company car drivers choosing a pure electric vehicle with zero emissions will not be liable to pay any benefit in kind tax at all. The rate will be gradually increased, rising to 1% for the tax year 2021-22 and 2% for 2022-23.

The same tax advantages will also apply to drivers of electric company cars with emissions between 1–50 CO2 (g/km) – so long as the car has an electric range of more than 130 miles and is registered after 6th April 2020.

However, company cars registered before April 6, 2020, with emissions from 1-50g/km and a pure electric mile range of 130 miles or more attract a 2% BIK rate in 2020/21 and stay the same for the two subsequent tax years.

Details of all the changes are set out in two new benefit in kind tables drawn up by the Treasury for company car drivers – one for those driving a vehicle registered before 6th April 2020, the other for drivers of vehicles registered after this date.

New Benefit in Kind Tax Rates for Electric Vehicles: The Headlines

- Percentage benefit in kind tax for cars registered before 6th April 2020

2. Percentage benefit in kind tax for cars registered from 6th April 2020

Is it Time to Think Again About a Company Car?

Until now, it’s been difficult for business owners to justify buying a car through their business. But these new changes to benefit in kind tax will make many people look again at their options.

If you’re considering investing in electric vehicles – as company cars for you or your staff, or maybe even as a fleet solution, Inca can help you decide what’s best for you, your business – and the planet!

For help and advice on going electric, call us now on 01235 868888 or email us at [email protected].