Major reforms to the way businesses in the construction and building sector account for VAT on specified supplies are coming into effect on 1st October 2019.

In the first of two blogs dedicated to this topic (Domestic Reverse Charge VAT #1), we took an overview of the domestic reverse charge (reverse charge) – looking in brief at how it will work, the services it will apply to, and the impact it’s likely to have on smaller businesses.

In this second blog post, we consider the steps you need to take to prepare for the imminent change if it’s going to affect your business.

Why it’s important for your business to be ready for the reverse charge

The reverse charge represents a significant change to the way businesses in the construction and building sector have to account for VAT on certain types of services.

Businesses will need to make adjustments to their systems and processes, and initially, the new regulations are likely to cause some disruption. HMRC has acknowledged this and indicated that for the first 6 months they will apply a ‘light touch’ in dealing with any errors – so long as the business owner is able to demonstrate that they are trying to comply with the new legislation and have acted in good faith.

But beware – light touch doesn’t mean soft touch: HMRC will still want to recover all revenue due to them. Mistakes made during this initial period will need to be set right, and any tax due to HMRC will have to be settled. A business knowingly and erroneously claiming end-user status can expect to be fined as well as having to pay any tax due.

In this second blog post, we consider the steps you need to take to prepare for the imminent change if it’s going to affect your business.

Preparing for the Domestic Reverse Charge: 4 Key Steps

-

Check whether the reverse charge is going to affect your sales, purchases – or both

The first thing you’ll need to do is review your sales and purchases to check which of your transactions will be affected by the reverse charge after 1st October. The extent to which you’ll be impacted will depend on whether you are a contractor, subcontractor – or both.

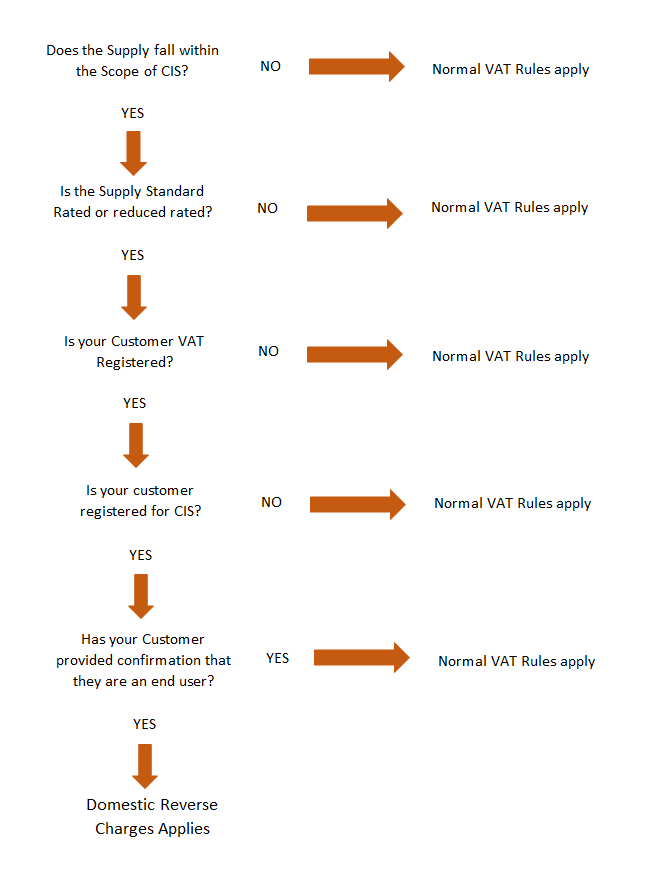

You can use the flow chart below to check if the reverse charge applies to supplies you’re making:

If you’re a contractor, you’ll need to review all your contracts with subcontractors to decide if the reverse charge will apply to the services you receive under your contracts. If it will, you’ll need to notify them.

If you’re a subcontractor, you’ll need to contact your customers to get confirmation from them if the reverse charge will apply, including confirming if the customer is an end-user or intermediary supplier.

2. Make sure your accounting systems & processes are ready to deal with the reverse charge

You will need to allow time to make adjustments to your accounting system and processes so that VAT is recorded and reported in line with the new rules.

When you invoice customers for a service you’ve supplied that is subject to the domestic reverse charge, your invoice will need to show all the information required on a VAT invoice, carry wording to indicate that the domestic reverse charge applies and that your customer is required to account for the VAT, and clearly state how much VAT is due under the reverse charge.

3. Ensure your staff are up to speed with the change

Before 1st October, you’ll need to communicate details of the upcoming change to everyone in your team who needs to know about it, and ensure that relevant staff have a good understanding of how the reverse charge works.

Having your team fully up to speed from the outset will reduce the likelihood of you needing to spend time correcting errors early on.

4. Consider whether the change will have an impact on your cash flow

Even though VAT ultimately makes its way through the accounts of businesses to the coffers of the Exchequer, the introduction of the reverse charge could impact on the cash flow of some businesses.

If you rely on using the VAT you charge as working capital; you’ll need to plan for reduced cash flow. And if looking ahead, you can see that your VAT Return is going to move from being a net claim to being a net payment, you will want to apply to HMRC to move to monthly rather than quarterly returns so that payments due to you are speeded up.

Let Inca Help You Get Set for Reverse Charging VAT!

If you run a busy CIS registered business, preparing for the domestic reverse charge is likely to be a time-consuming chore you could well do without. But getting ready for and introducing the new scheme needn’t interrupt regular business or take you away from more profitable opportunities.

With our in-depth knowledge of the reverse charge and our considerable experience supporting clients in the construction and building sector, we can help you to assess its potential impact, work with you to get ready for 1st October, and support you as the new rules come into effect – so any disruption to your business is minimised.

Get in touch with us now for an initial chat by calling us on 01235 868888 or email us at [email protected].